As a business owner looking to expand your horizons, understanding the complexities and opportunities of entering new markets is critical. Invest in Iran with Confidence; Legal Insights & Market Entry Strategies offers a comprehensive guide for companies eager to explore Iran’s strategic location, skilled workforce and growing regional influence within the realm of international trade. Navigating this unique legal and regulatory environment requires expert guidance.

At LibraLaw, our team of legal experts is dedicated to helping forward-thinking companies like yours seize these opportunities safely and successfully. In the following discussion, our specialists will provide clear, practical insights into Iran’s economic potential and legal landscape.

Why Is Iran the Next Hotspot for Business Growth and Export Opportunities?

Iran presents a wealth of opportunities for companies aiming to broaden their operations, particularly those focused on job creation and technology transfer; Its strategic geographical location is one of the country’s most compelling advantages, positioning Iran as a vital gateway to lucrative markets in the Persian Gulf and Central Asia. This unique access allows foreign investors not only to tap into Iran’s domestic market, but also to use it as a launchpad to reach neighboring countries with diverse and growing economies.

For businesses seeking diversification and growth, Iran offers direct connectivity to multiple regional markets with rising demand for goods and services; This means companies can establish a presence in Iran and simultaneously expand their reach into emerging markets such as the Gulf Cooperation Council (GCC) countries, Kazakhstan, Turkmenistan and Azerbaijan.

By leveraging Iran’s transport infrastructure — ports, railways and highways — foreign investors can optimize their supply chains, reduce costs and improve delivery times across the region.

For a comprehensive overview of legal considerations for foreign investors entering Iran, please refer to the article «The Complete Legal Guide for Foreign Investors in Iran».

Moreover, Iran’s commitment to industrial development, combined with government incentives, encourages foreign enterprises to bring in new technologies and expertise; This not only boosts the local economy, but also enhances the competitive edge of international firms operating there.

For companies ready to invest thoughtfully and strategically, Iran offers a fertile environment to create sustainable business growth while contributing to regional economic integration.

How Can Iran’s Strategic Location Unlock New Export Markets for Your Business?

For business owners aiming to expand regionally, Iran’s strategic location offers valuable export opportunities that can serve as a launchpad for broader market access. Understanding these key advantages can help you position your company for sustainable growth:

1. Access to the Persian Gulf Markets

Iran borders the Persian Gulf, providing direct access to some of the world’s wealthiest and most import-dependent countries; These nations have high demand for energy resources, construction materials and cutting-edge technology.

By setting up operations in Iran, your business can significantly reduce shipping times and costs, build reliable local partnerships and tap into lucrative contracts; This proximity also makes it easier to adapt products to meet regional needs, increasing your competitiveness.

2. Entry to Central Asian Markets

Central Asia is an emerging market with rapidly growing consumer demand for diverse products like food, machinery and raw materials. Iran acts as a natural gateway to countries such as Kazakhstan, Turkmenistan and Azerbaijan. For businesses, this means you can use Iran as a distribution hub to reach these markets more efficiently, reducing logistical complexities and customs barriers.

Leveraging Iran’s infrastructure enables quicker delivery times and the potential to scale your operations as these markets develop.

3. Expansion into Neighboring Regions

Success in the Iranian market also opens doors to neighboring Middle Eastern and even Eastern European countries through established ports and transport networks; This connectivity allows you to create robust supply chains and expand your customer base without the need for costly, standalone setups in each country. By integrating your logistics through Iran, your business gains flexibility and resilience, adapting quickly to regional demand fluctuations and regulatory changes.

By understanding and utilizing these export pathways, business owners can strategically expand their footprint, optimize costs and build lasting regional partnerships — key factors for thriving in today’s competitive global marketplace.

How Can Iran’s Strengths Transform Your Business Expansion Plans?

When considering international expansion, understanding a country’s competitive advantages is crucial to making informed investment decisions. Iran offers several key strengths that can provide your business with significant operational and strategic benefits:

- Cost Efficiency

Iran stands out for its competitive pricing on both labor and raw materials. For manufacturers and production-focused companies, this means substantially lower input costs compared to many other markets; These savings directly improve profit margins and can provide your business with a pricing advantage in regional and global markets. Additionally, cost efficiency in Iran can support more flexible pricing strategies, enabling you to better respond to market fluctuations or competitive pressures.

- Skilled Workforce

Iran is home to a well-educated, technically skilled labor pool, particularly in fields such as engineering, IT, and the sciences. This talent base is a significant asset for companies aiming to innovate, transfer technology or enhance product quality.

Many international firms have successfully leveraged Iranian expertise to strengthen their local operations and R&D capabilities. Access to such skilled professionals not only boosts operational efficiency but also helps your business adapt quickly to evolving market demands.

- Government Support for Value-Added Investment

The Iranian government actively encourages foreign companies that contribute beyond capital investment — particularly those that create jobs and facilitate technology transfer; This policy environment offers incentives for businesses committed to sustainable development and long-term engagement.

By aligning your investment strategy with these priorities, your company can benefit from regulatory support, potential tax incentives and improved relationships with local stakeholders.

While Iran’s advantages are substantial, success in this market requires careful planning and a long-term perspective. Short-term, opportunistic ventures often struggle due to regulatory complexities and the need to build trust within local networks. Companies that approach Iran with a sustainable growth mindset — prioritizing relationship building, compliance, and value creation — are more likely to establish a durable and profitable presence.

This competitive edge makes Iran an increasingly attractive destination for businesses seeking regional expansion and cost-effective operations. However, integrating these advantages into your strategic planning is essential for maximizing benefits and mitigating risks.

How Does Iran’s FIPPA Law Protect and Empower Foreign Investors?

For international investors, legal protection and clear incentives are crucial when entering a new market. Iran’s Foreign Investment Promotion and Protection Act (FIPPA) plays a pivotal role in creating a secure and attractive environment for foreign businesses. Understanding FIPPA’s provisions helps investors confidently navigate the Iranian market, reducing risk while maximizing potential returns.

Here are the key protections and benefits that FIPPA offers to foreign investors:

1. Guarantee of Capital Repatriation

One of the most critical assurances FIPPA provides is the right for foreign investors to repatriate their capital and profits freely, without unnecessary restrictions; This means your business can transfer earnings and investment funds back to your home country without facing burdensome bureaucratic obstacles or delays. This provision is essential for financial planning and offers peace of mind regarding liquidity and fund accessibility.

2. Protection Against Expropriation

FIPPA safeguards investors from the risk of unjust asset seizure by the Iranian government. In the event that any property or investment is expropriated for public use, the law guarantees fair compensation based on the current market value; This legal protection significantly reduces political risk and reassures companies that their investments are secure, even in uncertain circumstances.

3. Attractive Tax Incentives

To encourage foreign investment, Iran provides tax breaks under FIPPA. Eligible companies — especially those in technology, manufacturing and export sectors — may benefit from tax exemptions or reduced rates, such as tax holidays for certain periods; These financial incentives improve your investment’s profitability and help ease initial setup costs, making Iran a financially viable location for expansion.

For a detailed understanding of the tax incentives and regulations available to foreign investors, please refer to the article «A Practical Guide to Iranian Tax Laws for Foreign Investors».

4. Protection of Intellectual Property Rights

For companies bringing innovation, technology, or proprietary knowledge to Iran, FIPPA ensures robust protection of intellectual property (IP); This includes patents, trademarks and trade secrets, all safeguarded under Iranian law. Such protections are crucial for businesses aiming to maintain their competitive advantage and prevent unauthorized use or infringement of their innovations.

For more detailed strategies on safeguarding your IP rights in Iran, see our article «Protect Your Business; Essential Strategies for Safeguarding Intellectual Property in Iran».

By offering these protections and incentives, FIPPA establishes Iran as a more reliable and investor-friendly destination. However, successfully leveraging these benefits requires knowledgeable legal guidance to ensure compliance and to structure investments appropriately. Partnering with legal experts familiar with FIPPA can help your business fully capitalize on these advantages while minimizing risks.

Why Is FIPPA Essential for Protecting Foreign Investors in Iran?

Foreign companies considering Iran as a potential market should view FIPPA as a strong legal safeguard that ensures a level of security not always found in emerging markets. By guaranteeing the rights of investors, offering tax incentives, and ensuring the protection of intellectual property, FIPPA creates an environment where businesses can thrive. It also sends a message to the international community that Iran is committed to fostering foreign investment and engaging in global trade.

The importance of FIPPA in fostering investor confidence is thoroughly outlined in the article «Foreign Investment in Iran; How FIPPA Protects Your Capital».

It’s important to approach the Iranian market with the right legal guidance to ensure compliance with FIPPA and maximize the benefits it offers. This is where working with experienced legal consultants and Iranian business experts, such as those from Libralaw, can provide invaluable assistance in navigating the complexities of FIPPA and ensuring your business interests are fully protected.

What Practical Steps Should Business Owners Take to Succeed in the Iranian Market?

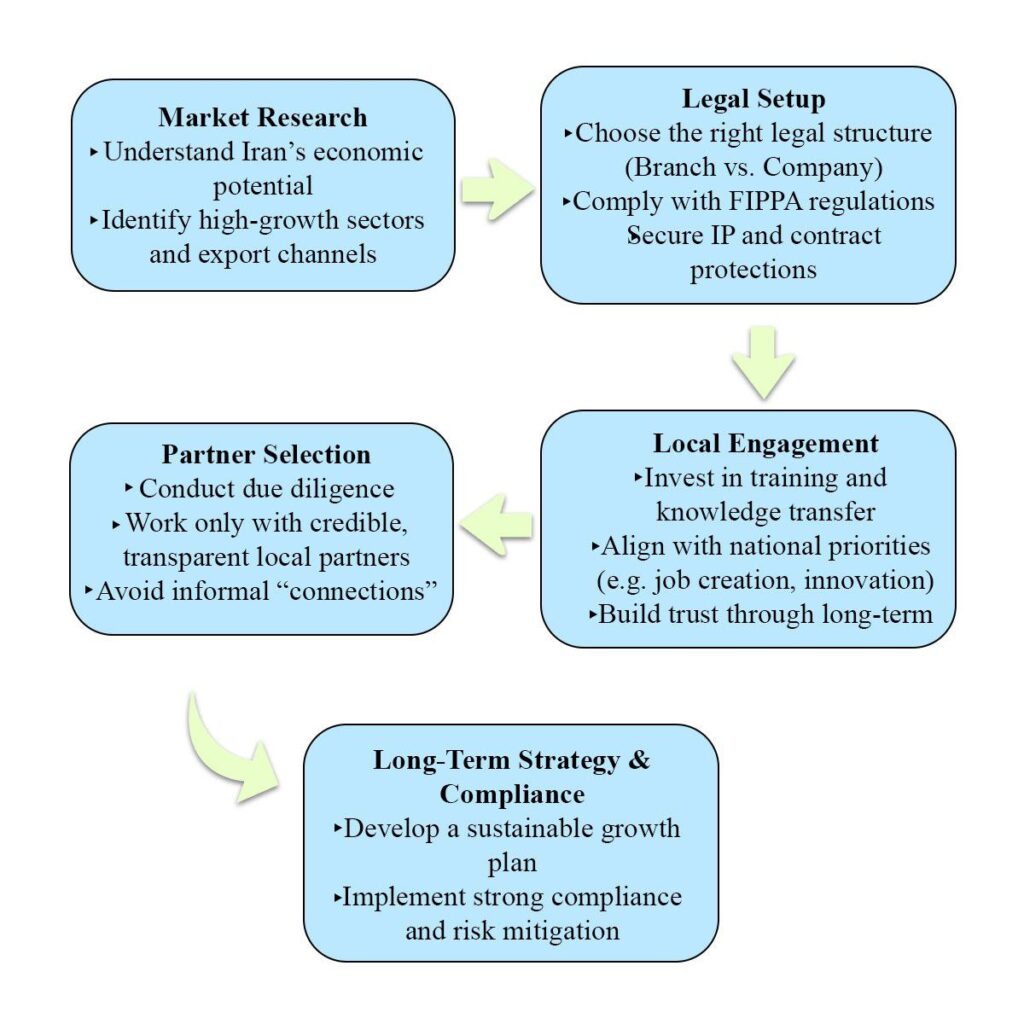

Entering the Iranian market presents significant growth opportunities, but also distinct challenges requiring more than simple legal compliance. Successful investment in Iran demands cultural awareness, strategic planning, strong local partnerships and a long-term vision. This guide offers a comprehensive roadmap for business owners to navigate Iran’s complex business landscape effectively and sustainably.

1. Engage Qualified Local Experts, Avoid Relying on Informal “Connections”

Many foreign businesses make the mistake of trusting individuals who promise access through “connections” or unofficial channels. Such shortcuts often result in legal complications, unreliable partnerships or even sanctions violations. Instead:

- Partner exclusively with licensed and reputable consultants, Iranian lawyers, and industry specialists who have a thorough understanding of local regulations and business practices.

- These professionals provide transparent, compliant guidance, mitigating risks associated with unfamiliar legal frameworks.

Key takeaway: Prioritize professionalism and legal compliance to build a foundation of trust and security for your investment.

2. Select Partners Based on Proven Experience and Credibility

Choosing the right Iranian business partner is crucial for success. To ensure reliability:

- Conduct comprehensive due diligence — scrutinize financial transparency, review past projects, verify credentials and ask for references.

- Be cautious of partners who:

- Lack clear financial records;

- Promise “exclusive” or “politically connected” access;

- Resist independent legal counsel or formal contracts.

- Instead, focus on partners with proven technical expertise, industry experience, and a track record of ethical business practices.

Key takeaway: Reliable partnerships built on merit and transparency reduce operational risks and foster sustainable growth.

3. Commit to Knowledge Transfer and Local Capacity Building

Long-term success in Iran depends on contributing value beyond capital. Companies that bring technology, skills and sustainable practices are welcomed by government and local stakeholders alike. Consider:

- Investing in training local employees and transferring technical know-how;

- Introducing internationally recognized quality and governance standards;

- Building joint ventures or programs that empower local communities and industries.

For instance, a European manufacturing company in Isfahan successfully gained government support and expanded operations by training Iranian engineers and implementing new quality assurance systems that were previously unfamiliar in the region; This commitment to local capacity building significantly enhanced its reputation and opened doors to new business opportunities.

Key takeaway: Integrating knowledge transfer strengthens your reputation, unlocks incentives and ensures community acceptance.

4. Choose the Appropriate Legal Structure; Branch Office vs. Iranian Registered Company

Foreign companies typically establish their presence through one of two legal forms:

- Branch Office: Best for liaison, research or supervision, but limited in commercial operations.

- Iranian Registered Company: Enables full-scale commercial activities (manufacturing, import/export, services). Foreigners can own 100% under FIPPA compliance.

Each option involves different tax, liability and regulatory implications. Consult local legal experts to select the structure that aligns with your business objectives and sector needs.

For more detailed information on selecting the right legal structure for foreign investment in Iran, please refer to the article «A Simple Guide to Entering the Iranian Market; Choosing the Right Legal Structure for Foreign Investment».

Key takeaway: The right legal form is essential for operational efficiency and compliance.

For assistance with setting up the right legal structure and managing all related legal processes in Iran, click here.

Business Success Roadmap in Iran

5. Develop a Long-Term Business Vision Beyond Immediate Gains

Iran’s market is rich in potential, particularly in sectors like energy, pharmaceuticals, ICT and infrastructure; but quick profits are rare. Successful investors:

- Embrace a multi-year growth strategy, focusing on sustainable market positioning.

- Understand that building brand trust and operational resilience requires time and commitment.

Key takeaway: Viewing Iran as a strategic, long-term investment opportunity sets the stage for enduring success.

6. Exercise Strategic Patience and Local Engagement

Iran’s regulatory and economic environment is complex and sometimes unpredictable. Companies that thrive:

- Commit to gradual development rather than rapid expansion;

- Adapt continuously to changing local policies and market dynamics;

- Maintain strong compliance frameworks to anticipate and mitigate risks;

For example, multinational firms in the healthcare and automotive sectors that remained committed and actively engaged during periods of sanctions have now established market leadership and benefit from optimized supply chains; Their patience and flexibility allowed them to weather challenges and emerge stronger.

Key takeaway: Patience and local adaptation help navigate uncertainties and foster resilience.

7. Translate Vision into Concrete, Actionable Plans

A clear vision must be supported by detailed planning. Essential elements include:

- Currency risk management strategies to address volatility and inflation;

- Localization initiatives such as local sourcing, hiring and corporate social responsibility programs;

- A robust internal governance system for regulatory compliance;

- Defined exit strategies and mechanisms for profit repatriation to safeguard investments.

At LibraLaw, we assist clients in developing tailored entry and expansion roadmaps that balance Iranian regulatory requirements with international compliance, including sanctions and export controls.

Key takeaway: Well-structured, realistic plans convert strategic goals into measurable results.

8. Avoid Short-Term Profit-Only Approaches

Iranian regulators favor companies that contribute positively to the economy and society. Investors focused solely on quick profits often face regulatory hurdles and reputational challenges. Instead, successful companies:

- Invest in workforce development, technology upgrades and ecosystem growth;

- Benefit from incentives such as tax exemptions, priority in land allocation and expedited licensing.

Key takeaway: Long-term contributions build goodwill and unlock preferential treatment.

9. Prepare for Political and Economic Uncertainty Through Scenario Planning

Iran’s business climate can shift rapidly due to internal or international developments. Effective risk management includes:

- Incorporating force majeure clauses tailored to Iranian law;

- Defining clear renegotiation and termination rights in contracts;

- Using currency adjustment clauses to mitigate inflation and exchange rate risks;

- Including arbitration provisions that allow dispute resolution in local or international forums.

Key takeaway: Scenario planning protects investments and sustains your reputation during turbulent times.

10. Ensure Full Compliance to Protect and Grow Your Business

Adherence to both Iranian regulations and international legal frameworks (including AML, CFT and sanctions laws) is critical. Non-compliance risks severe penalties and reputational damage.

LibraLaw provides integrated compliance solutions tailored to the complexities of operating in Iran, helping businesses navigate domestic laws and cross-border challenges confidently and ethically.

Key takeaway: Proactive compliance is not just a legal obligation but a strategic advantage.

Entering the Iranian market successfully requires more than capital; it demands a blend of local expertise, careful partner selection, knowledge sharing, legal foresight, strategic patience and rigorous compliance. By following these practical steps, business owners can build sustainable operations that thrive amid Iran’s evolving landscape.

Conclusion; Invest Smart, Grow Steady

Iran presents a unique investment landscape—rich in opportunity but complex in execution. For foreign businesses, success depends not only on identifying the right sectors and partners but also on navigating the legal and operational environment with foresight and precision.

From leveraging Iran’s export advantages and industrial capabilities, to building partnerships based on merit and long-term value, every decision counts. As shown by past experiences, those companies that approached Iran with transparency, strategic patience and a commitment to local development have built sustainable operations and earned trust from both regulators and communities. However, entering Iran without a clear roadmap or relying on unofficial shortcuts can quickly lead to costly missteps.

Navigating the complex legal landscape of doing business in Iran is not just challenging; it can be risky without the right expertise. Engaging with specialized legal counsel is absolutely essential to avoid costly mistakes, ensure full compliance and protect your investments.

If you are planning to enter or expand in the Iranian market, professional legal guidance is not optional; it’s a critical step for your success. At LibraLaw, our team of highly experienced legal experts possesses in-depth knowledge of Iran’s regulatory environment and international investment laws. We are fully equipped to help you overcome legal hurdles, minimize risks and seize opportunities confidently.

Don’t leave your business vulnerable to unforeseen legal challenges. Reach out to LibraLaw today for trusted advice and strategic support tailored to your unique needs. Your investment deserves the protection and expertise that only seasoned professionals can provide. Contact us now to secure your business future in Iran.